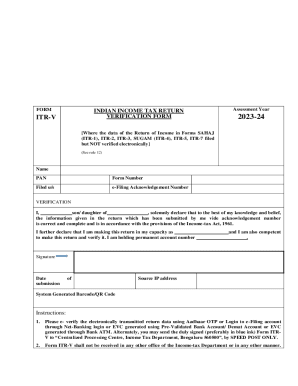

India ITR-V 2010 free printable template

Show details

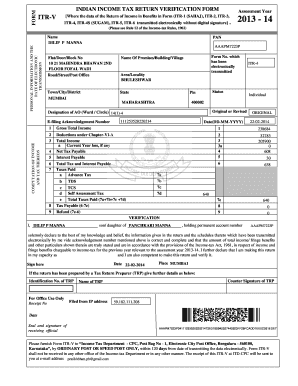

ITV. INDIAN INCOME TAX RETURN VERIFICATION FORM. Where the data of ... e Total Taxes Paid (7a+7b+7c +7d). 7e. 8 Tax Payable (6-7e). 8. CO. MP. UT.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your itr v acknowledgement ay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your itr v acknowledgement ay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing itr v acknowledgement ay 21 pdf online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit itr copy sample form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

India ITR-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out itr v acknowledgement ay

How to fill out itr v acknowledgement ay:

01

Start by downloading the ITR V Acknowledgement form from the official website of the Income Tax Department.

02

Carefully read all the instructions mentioned on the form to understand the requirements and guidelines for filling it out.

03

Fill in your personal details accurately, such as your name, address, contact information, and Permanent Account Number (PAN).

04

Make sure to complete all the relevant sections of the form, including the assessment year and the date of filing.

05

Double-check all the information filled in before signing the form, ensuring there are no errors or discrepancies.

06

If you are filing the form on behalf of another individual or entity, provide the necessary authorization details and attach the required documents if applicable.

07

Sign the form in the designated space.

08

After completing the form, mail the signed copy to the Income Tax Department's Centralized Processing Center within the stipulated time.

Who needs itr v acknowledgement ay:

01

Any individual or entity who files their income tax return online using the ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, or ITR-6 forms needs to submit the ITR V Acknowledgement.

02

This acknowledgement serves as proof that the income tax return has been successfully filed.

03

It needs to be submitted to the Income Tax Department within the specified time frame, usually within 120 days of filing the return electronically.

Fill itr v acknowledgement 2020 21 pdf : Try Risk Free

People Also Ask about itr v acknowledgement ay 21 pdf

How can I know my ITR Acknowledgement?

How can I download my ITR Acknowledgement?

What is the difference between ITR-V and ITR Acknowledgement?

Where do I send my ITR V Acknowledgement?

How do I get an e-filing Acknowledgement?

How do I file an ITR Acknowledgement?

How to open income tax acknowledgement pdf?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on itr v acknowledgement ay?

ITR-V Acknowledgement will include information like:

1. Acknowledgement Number

2. Assessing Officer Code

3. Date of filing

4. Permanent Account Number (PAN)

5. Name of the Assessee

6. Status of filing

7. Verification details

8. Details of tax paid, if any

When is the deadline to file itr v acknowledgement ay in 2023?

The deadline for filing ITR-V Acknowledgement for the AY 2023-24 is 31st July 2024.

What is itr v acknowledgement ay?

ITR-V Acknowledgement AY stands for Income Tax Return-Verification Acknowledgement Assessment Year. It is a receipt that is generated upon successful e-filing of an Income Tax Return (ITR) in India. It is a mandatory document that confirms the submission of the ITR by the taxpayer and serves as proof of filing the return with the Income Tax Department. The ITR-V Acknowledgement AY needs to be physically signed and sent to the Income Tax Department's Centralized Processing Centre within 120 days from the date of e-filing. Once the ITR-V Acknowledgement is received and verified by the department, it completes the process of filing the income tax return.

Who is required to file itr v acknowledgement ay?

All individuals who have filed their income tax return (ITR) online without using a digital signature certificate are required to file ITR-V acknowledgement for assessment year (AY).

How to fill out itr v acknowledgement ay?

To fill out the ITR-V acknowledgement form for Assessment Year (AY), follow these steps:

1. Visit the Income Tax e-Filing website (incometaxindiaefiling.gov.in) and log in with your credentials (PAN number, password, and captcha).

2. Once logged in, go to the 'My Account' tab and select 'e-Verify Return' from the dropdown menu.

3. You will see a list of returns filed by you. Select the relevant AY for which you want to fill out the ITR-V acknowledgement.

4. Click on the "View Returns/Forms" option from the list.

5. In the next page, you will find a list of different forms. Look for the ITR-V option and click on the acknowledgment number.

6. Now, you can download the ITR-V acknowledgement form by clicking on the download button.

7. Print the downloaded ITR-V form and sign it using a blue or black ink pen.

8. Make sure the signature is clear and matches the one on your PAN card.

9. If your income is below Rs. 5 lakhs and you didn't claim any refund, you can use ordinary post or speed post to send the signed ITR-V form to the Centralized Processing Centre (CPC) within 120 days from the date of filing the return.

10. If your income is above Rs. 5 lakhs or you claimed a refund, you need to e-verify the return electronically. You can choose from several options like using an Electronic Verification Code (EVC), Aadhaar OTP, or net banking to complete the e-verification process.

11. Once e-verification is done, there is no need to send the physical copy of the ITR-V form to the CPC.

Remember to keep a copy of the signed ITR-V form and the tracking number in case you send it via post.

Note: The process may vary slightly based on the specific updates on the income tax website. It is always recommended to refer to the official website or consult a tax professional for the most up-to-date instructions.

What is the purpose of itr v acknowledgement ay?

The purpose of ITR-V acknowledgement in India is to verify the authenticity and correctness of electronically filed income tax returns. When taxpayers file their income tax return online, they receive an acknowledgement called ITR-V (Income Tax Return-Verification) which serves as proof of filing the tax return. It must be signed, printed, and physically sent to the Centralized Processing Center (CPC) in Bangalore within a specified time frame. It is used to validate the tax return and complete the filing process.

What is the penalty for the late filing of itr v acknowledgement ay?

The penalty for late filing of ITR-V acknowledgement for AY (Assessment Year) is as follows:

1. If the return is filed after the due date but before 31st December of the assessment year, a late filing fee of Rs. 5,000 will be applicable.

2. If the return is filed after 31st December of the assessment year, a late filing fee of Rs. 10,000 will be applicable.

3. In case the total income does not exceed Rs. 5 lakh, the maximum late filing fee is limited to Rs. 1,000.

It is important to note that the penalty is applicable only if there is a tax liability and the return is filed after the due date.

How do I complete itr v acknowledgement ay 21 pdf online?

pdfFiller has made filling out and eSigning itr copy sample form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the itr 4 acknowledgement 21 pdf in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your itr acknowledgement download pdf in minutes.

Can I create an electronic signature for signing my itr format in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your itr v acknowledgement ay 21 form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Fill out your itr v acknowledgement ay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Itr 4 Acknowledgement 21 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to itr receipt form

Related to itr v acknowledgement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.